Shark Tank is a popular television show that provides a platform for aspiring entrepreneurs to pitch their business ideas to a panel of experienced investors, known as the “sharks”. While equity investments are commonly discussed on the show, advisory shares play a significant role as well. Advisory shares are a unique form of compensation offered to the sharks in exchange for their invaluable expertise, guidance, and industry connections.

In this article, we will delve into the concept of advisory shares, explore their benefits and implications, and shed light on their role within the dynamic world of Shark Tank. So, let’s dive in and uncover the intriguing realm of advisory shares on Shark Tank!

Basic Information About Advisory Shares:

What Are Advisory Shares?

These shares are commonly used to incentivize experienced advisors and consultants to contribute their knowledge and network to the growth and success of the company.

What’s The Difference Between Advisory Shares And Regular Shares?

What sets advisory shares apart from regular shares is their distinct nature and purpose. While regular shares represent ownership and financial interest in a company, advisory shares do not grant the same rights and privileges. Instead, advisory shares are typically non-voting and do not entitle the holder to dividends or a share of the company’s profits. They are purely a mechanism for rewarding individuals for their advisory contributions.

The primary difference between advisory shares and regular shares lies in their intended function. Regular shares are issued to investors and employees as a means of capitalizing the company and sharing in its financial success. They confer ownership rights, such as voting rights on company matters, the ability to receive dividends, and a share of the proceeds in the event of a sale or liquidation.

On the other hand, advisory shares are specifically designed to reward advisors for their expertise, industry knowledge, and mentorship. They allow companies to tap into the experience of seasoned professionals without giving up voting control or diluting ownership stakes. Advisory shares are typically granted to advisors for a fixed period, such as a few years, or until certain milestones or goals are achieved. The terms of the advisory shares, including vesting schedules and any potential cash or equity compensation, are usually negotiated between the company and the advisor.

While advisory shares do not carry the same financial benefits as regular shares, they can still be highly valuable. They provide advisors with an opportunity to align themselves with the company’s success and benefit from its growth.

In some cases, advisory shares can also be converted into regular shares or receive other forms of compensation if specific triggering events occur, such as an initial public offering (IPO) or an acquisition [2].

Overall, advisory shares serve as a strategic tool for companies to attract and retain experienced advisors who can contribute to their strategic decision-making and overall development. By offering this form of equity participation, companies can leverage the expertise of advisors without compromising ownership or control, making it a win-win arrangement for both parties involved.

What Are The Different Types Of Advisory Shares:

- Stock Options: Stock options are a type of financial derivative that gives advisors the right, but not the obligation, to purchase company stock at a predetermined price within a specified period. The predetermined price is known as the exercise price or strike price. Stock options often have a vesting period, during which the advisor must fulfill certain requirements or remain with the company for a specific duration before exercising their options. Once the options are exercised, the advisor can acquire company shares at the predetermined price, allowing them to benefit from any appreciation in the stock’s value;

- Restricted Stock: Restricted stock refers to actual shares of company stock that are granted to advisors but are subject to certain restrictions or conditions. These restrictions typically include a vesting schedule or performance milestones that the advisor must meet before gaining full ownership of the shares. Until the restrictions lapse, the advisor does not have full control over the shares, and they may be forfeited if the conditions are not met. However, during the restricted period, the advisor may still receive dividends and have voting rights;

- Phantom Shares: Phantom shares are a form of synthetic equity that provides advisors with a cash or stock-based bonus that mirrors the value of actual company shares. Phantom shares do not grant ownership in the company, but they entitle the advisor to receive a payout based on the increase in the company’s value over a specified period. This type of advisory share allows the advisor to participate in the financial success of the company without holding actual ownership;

- Stock Appreciation Rights (SARs): Stock appreciation rights are similar to phantom shares in that they provide advisors with a cash or stock-based bonus linked to the increase in the company’s stock price. SARs give advisors the right to receive appreciation in the value of a specific number of company shares over a predetermined period. Unlike phantom shares, SARs are usually settled in cash [3];

What Is The Vesting Schedule For Advisory Shares?

The vesting schedule for advisory shares refers to the timeline or conditions under which the advisor becomes eligible to receive ownership or full control over the granted shares. It outlines the period over which the advisor’s rights to the shares gradually accrue and may include specific milestones or performance criteria that need to be met. The vesting schedule for advisory shares can vary depending on the company’s policies and the negotiated terms between the company and the advisor.

Here are some common elements that may be present in a vesting schedule:

- Vesting Period: The vesting period is the total duration over which the advisory shares gradually become vested or owned by the advisor. This period is typically measured in months or years and can range from a few months to several years. It is important to note that until the shares are fully vested, the advisor may not have complete control over them;

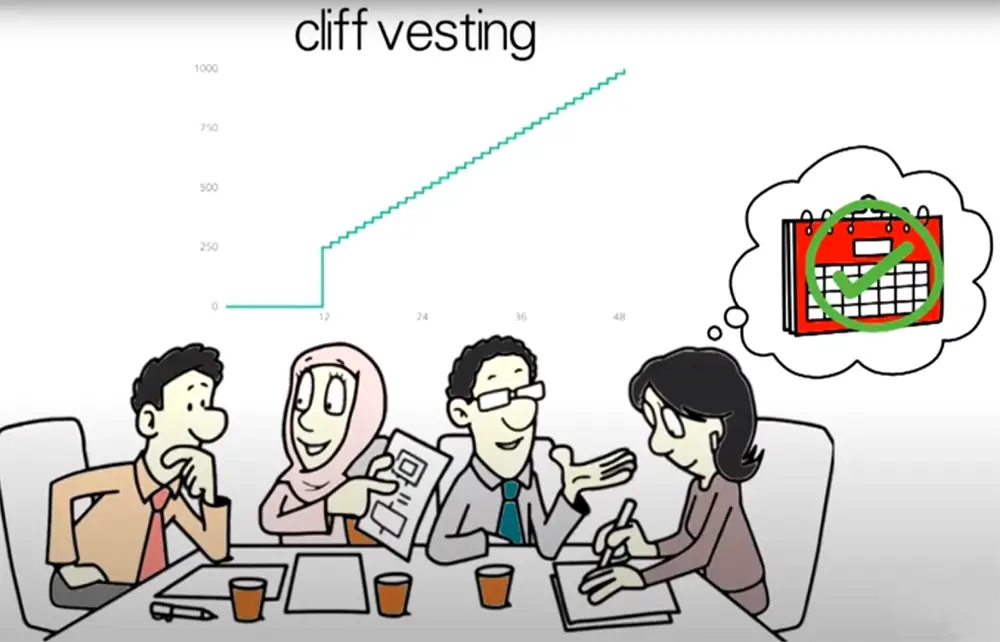

- Cliff Vesting: Cliff vesting refers to a specific milestone within the vesting period where a significant portion of the shares becomes vested all at once. For example, a cliff vesting period of one year might mean that no shares vest until the advisor completes one year of service, at which point a substantial portion of the shares becomes fully vested. Cliff vesting is commonly used to provide incentives for advisors to stay with the company for a certain period before gaining ownership rights;

- Gradual Vesting: Gradual vesting involves the gradual accumulation of ownership rights over time. Instead of a single cliff vesting event, shares may vest in increments or percentages at regular intervals. or instance, a common vesting schedule is “4-year vesting with a one-year cliff”, where the advisor’s ownership increases by 25% at the end of each year, with no ownership until the first anniversary;

- Performance-Based Vesting: In some cases, the vesting of advisory shares may be contingent upon the achievement of specific performance goals or milestones. These goals could be related to the company’s financial performance, reaching sales targets, or other predetermined objectives. Performance-based vesting provides an additional layer of alignment between the advisor’s contributions and the vesting of their shares [4];

The terms and conditions of the vesting schedule are typically negotiated during the advisory agreement or contract, taking into consideration factors such as the advisor’s level of expertise, expected time commitment, and the company’s growth trajectory.

Who Issues Advisory Shares?

Advisory shares are typically issued by private companies, startups, or even established companies looking to tap into the expertise and guidance of experienced professionals. The issuance of advisory shares is a strategic decision made by the company’s management team or board of directors to attract and retain advisors who can provide valuable insights and contribute to the company’s growth.

What Is an Advisory Board?

An advisory board is a group of external advisors who provide guidance, advice, and industry expertise to a company’s management team or board of directors. Advisory boards are typically composed of individuals with specialized knowledge or experience in relevant fields such as finance, marketing, technology, or specific industries. The members of the advisory board may be compensated for their services through various means, including the issuance of advisory shares.

What Is the Downside of Issuing Advisory Shares?

While advisory shares can be an effective tool for incentivizing and rewarding advisors, there are certain downsides to consider:

- Dilution of Ownership: Issuing advisory shares can dilute the ownership stakes of existing shareholders, including founders and early investors. This dilution occurs when new shares are issued and added to the overall share pool. Companies need to carefully consider the impact on ownership percentages and ensure that the benefits of issuing advisory shares outweigh the potential dilution;

- Lack of Control: Advisory shares do not grant voting rights to advisors. Therefore, the company can benefit from their advice and expertise without giving up decision-making control. However, this lack of voting rights may be seen as a disadvantage for advisors who want to have a say in the company’s strategic direction;

- Administrative Burden: Issuing and managing advisory shares can entail administrative complexities. Companies need to establish processes for tracking vesting schedules, maintaining accurate records, and addressing potential complications, such as when advisors leave the company or fail to meet performance criteria;

What Makes Advisory Shares Popular?

Advisory shares have gained popularity for several reasons:

- Expertise Access: Advisory shares allow companies to tap into the knowledge, industry connections, and mentorship of experienced advisors. By offering advisory shares, companies can attract top talent and benefit from their expertise without having to hire them as full-time employees;

- Flexibility: Advisory shares provide flexibility in compensation arrangements. They can be tailored to the specific needs and contributions of advisors, allowing companies to structure agreements based on time commitments, performance milestones, or other criteria;

- Alignment of Interests: Advisory shares align the interests of the company and the advisor. By granting ownership or the potential for future financial benefits, advisory shares motivate advisors to actively contribute to the company’s success, as their own rewards are tied to its performance;

- Retention and Engagement: Issuing advisory shares can enhance advisor retention and engagement. As advisors have a stake in the company’s success, they are likely to remain committed and involved over the long term, providing ongoing guidance and support;

Basic Information About Shark Tank:

What Is Shark Tank?

Shark Tank is a television show that first premiered on ABC on August 9, 2009 [5]. The show centers on the concept of entrepreneurs and inventors pitching their ideas and products to a group of affluent investors and business magnates, known as the sharks. The entrepreneurs come on the show with their ideas and hope to secure investments from the sharks in exchange for a stake in their business.

The show has become famous worldwide for its unique and thrilling format, combining the drama of reality TV with the excitement of entrepreneurship, business strategy, and innovative product development. It has also earned recognition for its ability to discover and promote new talent by providing exposure to small businesses, startups, and individual inventors and entrepreneurs with disruptive and innovative products.

How Does Shark Tank Work?

The first segment of the show begins with a brief introduction of the entrepreneurs, followed by a pitch presentation explaining their business plan, product, and revenue model. They also disclose the amount of money they want to secure in exchange for equity in their business.

The sharks, who are seated in a panel with their names on it, then have the option to either accept or decline the offer made by the entrepreneur, based on the quality and potential success of the product. A bit of negotiating often takes place, and the contestants find themselves facing objections, compliments, and sometimes, scorn from the sharks.

If one or more of the sharks decide to invest, the entrepreneurs must then negotiate terms before closing the deal. On the other hand, if the sharks are not interested, the entrepreneur is sent packing, usually with tough feedback, criticism, or advice aimed at helping them improve their pitch or product.

The Cast Of Shark Tank

The cast of Shark Tank features six main sharks, besides guest investors who appear occasionally. The sharks are known for their vast experience in business, uniquely diverse backgrounds, and success in entrepreneurship. They are:

- Mark Cuban: Mark Cuban is a well-known American billionaire, entrepreneur, and philanthropist. He is the founder of several companies, including Broadcast.Com, HDNet, and Magnolia Pictures. Cuban is known for his outspoken nature, and he has been called the “maverick billionaire” for his willingness to take risks;

- Barbara Corcoran: Barbara Corcoran is a prominent real estate investor and entrepreneur. She is the founder of The Corcoran Group, one of the largest real estate companies in the US. Corcoran has made a name for herself in the world of business by investing in and developing some of the most innovative and profitable businesses;

- Kevin O’Leary: Kevin O’Leary is a Canadian business magnate, investor, and TV personality. He is best known as the founder of O’Leary Funds and is often referred to as “Mr. Wonderful” on the show;

- Lori Greiner: Lori Greiner is a successful entrepreneur and inventor. She has created and marketed over 800 products and is known as the “Queen of QVC” for her many appearances on the network;

- Daymond John: Daymond John is a fashion entrepreneur, investor, and TV personality. He is the founder of FUBU, a streetwear brand that became popular in the 1990s, and has since gone on to become a successful investor and mentor to many new businesses;

- Robert Herjavec: Robert Herjavec is a Croatian-Canadian entrepreneur, investor, and TV personality. He is the founder of several successful companies, including The Herjavec Group, a cybersecurity firm that provides advanced protection against cyber-attacks [6];

Contestants Of Shark Tank

The contestants of Shark Tank are a diverse group of entrepreneurs from all walks of life, who come to the show to showcase their ideas and products to the sharks. These contestants have varying levels of experience in business and can be solo entrepreneurs or have team members behind them.

The Guide To Advisory Shares on Shark Tank: Peculiarities

What Are Advisory Shares on Shark Tank?

When an innovator presents a proposition on Shark Tank, they frequently propose offering advisory equity. For instance, if an investor suggests investing $100,000 in exchange for a ten percent interest in the business, this is commonly granted as an advisory share [7].

This enables the shark or investor to financially support the company and acquire a stake, without being granted tangible shares in the company.

This is significant as it helps prevent conflicts of interest and ensures that the owner maintains full ownership rights and can make business decisions autonomously.

Essentially, an advisory share is extended to the shark as a reciprocal arrangement for their professional counsel and guidance, along with a modest financial contribution. In return, the inventor or owner retains full control over the company.

Who Gives Out Advisory Shares on Shark Tank?

While the concept of advisory shares is commonly associated with the show Shark Tank, it is important to note that this term predates the television program. Advisory shares have been in use for a considerable period of time.

Advisory shares differ from the stock options typically granted to employees. Investors have the chance to purchase shares, but there may be limitations on the number of shares available to maintain the owner’s complete control over the company.

What Are the Benefits of Advisory Shares for Shark Tank Contestants?

Advisory shares offer advantages to both investors and start-up business owners. One of the key benefits is that they provide assistance to small or start-up businesses in accessing guidance and support without the immediate financial burden of paying for professional services.

Engaging a professional to provide guidance to a start-up business can be expensive, and many businesses may lack the necessary funds to cover such costs. By offering advisory shares, the start-up can provide compensation to the professional in the form of potential future value, rather than immediate payment.

The advantage for the investor or advisor lies in the potential for the rapid growth of the advisory shares if they are successful in helping the business thrive. This presents an opportunity for substantial financial gain if they genuinely believe in the business and it experiences significant growth.

By aligning the interests of both parties, advisory shares create a mutually beneficial relationship. The start-up business gains valuable guidance and support without incurring upfront costs, while the investor or advisor has the potential to earn substantial returns if the business flourishes. This arrangement fosters a sense of shared commitment and motivation toward the success of the business.

What Are the Downsides of Shark Tank’s Advisory Shares?

While there are several advantages to advisory shares, it is crucial to recognize that there are also certain drawbacks associated with them.

One of the disadvantages is that if the business fails, the value of the advisory shares can diminish or become worthless.

Consequently, advisors and investors may find themselves in a situation where their efforts yield no financial compensation. This can be disheartening, particularly if they have dedicated significant time and resources to the venture.

Another common disadvantage of advisory shares is the potential for disagreement between the advisor and the business owner regarding the company’s direction or future steps. While the business owner maintains full control over the business, the advisor may become frustrated if they feel that their advice is not being acknowledged, heeded, or implemented.

Such conflicts can generate internal tensions within the business and impede the timely release of products or decision-making processes. It is essential for both parties to establish effective communication channels and foster a collaborative environment to mitigate potential conflicts and ensure productive interactions.

How Much Can Be Given in Advisory Shares on Shark Tank?

During episodes of Shark Tank, it is not uncommon to witness advisors securing advisory shares ranging from 10 to 20 percent of a company’s valuation [8].

Nevertheless, it is essential to bear in mind that the show showcases renowned and accomplished advisors who command higher compensation than what most start-up companies would typically offer to their advisors.

In actual business settings, it is more customary for advisors to receive a portion of one to five percent of a company’s worth in advisory shares. It is quite unusual for companies to grant advisors a higher percentage than this.

What Does a Vesting Period Mean When It Comes to Advisory Shares On Shark Tank?

When advisory shares are issued, it is customary to establish a vesting period, typically ranging from one year (12 months) to five years (60 months).

The purpose of a vesting period is to restrict advisors from selling or cashing in their shares during this duration. This safeguards the business from the obligation of distributing shares it might not have the financial means to fulfill, while also ensuring that the advisor remains committed to the company for a specified period.

In essence, a longer vesting period means that the advisor is required to work for the company for an extended duration before they can exercise their right to cash in or sell their shares. The duration of the vesting period serves as a binding commitment between the advisor and the company, promoting long-term engagement and alignment of interests.

FAQ:

-

What is the benefit of advisory shares?

The benefit of advisory shares is that they allow start-up businesses to attract experienced advisors who provide valuable guidance, expertise, and industry connections. The advisors have a vested interest in the success of the company, aligning their incentives with the business’s growth.

-

Do advisory shares get dividends?

Advisory shares typically do not receive dividends as they are not the same as equity shares, which commonly entitle shareholders to a portion of the company’s profits [9].

-

Do advisory shares pay dividends?

Similar to the previous answer, advisory shares do not generally pay dividends.

-

How long do advisory shares last?

The duration of advisory shares can vary and is typically determined through negotiations between the company and the advisor. It can range from a few months to several years, depending on the terms agreed upon.

-

Do advisory shares get diluted?

Advisory shares can be subject to dilution if additional shares are issued by the company. Dilution occurs when the total number of shares increases, potentially reducing the percentage ownership of existing shareholders, including holders of advisory shares.

-

How do advisors get paid on shares?

Advisors may receive compensation through the appreciation of their advisory shares over time. They may also negotiate for additional compensation, such as cash fees or performance-based bonuses tied to specific milestones or targets [10].

-

Why do sharks want advisory shares?

Sharks on Shark Tank seek advisory shares in order to align themselves with the success of the businesses they invest in. They provide not only financial capital but also valuable expertise, industry connections, and mentorship to help the companies grow and thrive.

-

What is the difference between equity and advisory shares on Shark Tank?

Equity shares represent ownership stakes in a company and entitle the shareholders to various rights, including voting rights and dividends. Advisory shares, on the other hand, provide advisors with a stake in the company’s future success but may not carry the same voting rights or dividend entitlements.

-

How do advisory shares affect valuation?

The issuance of advisory shares can impact a company’s valuation as it represents an allocation of ownership to the advisors. The percentage of advisory shares granted and the expertise of the advisors can influence how potential investors or acquirers perceive the value and potential of the company.

-

How does Shark Tank work?

Shark Tank is a television show where aspiring entrepreneurs pitch their business ideas to a panel of wealthy investors, known as the “sharks.” The entrepreneurs seek investment offers from the sharks in exchange for an equity stake or advisory shares in their companies.

-

What happens to the share price when a company issues more shares?

When a company issues additional shares, it can potentially dilute the ownership percentage of existing shareholders. This could result in a decrease in the share price, as the ownership stake is spread among a larger number of shares.

-

Which Shark Tank investor is most successful?

The success of Shark Tank investors varies, and it is subjective to determine the most successful investor. Each shark has had notable successes and profitable investments, with their success measured by various factors, including the growth and profitability of the companies they invest in.

-

Do Shark Tank investors really invest?

Yes, the investors on Shark Tank do invest their own money in the businesses they choose to support. Once a deal is made on the show, the investors conduct further due diligence before finalizing the investment off-camera.

-

Have all 5 sharks ever invested in one product?

It is relatively rare for all five sharks to invest in a single product or business. Each shark has their own investment criteria, preferences, and areas of expertise. However, there have been instances where multiple sharks have collectively invested in a deal, demonstrating their shared interest and belief in a particular opportunity.

-

How do sharks make money from equity?

Sharks make money from equity by earning a return on their investment when the value of the company increases. They may receive dividends if the company distributes profits, and they can potentially make money through capital gains by selling their equity shares at a higher price than what they paid.

-

How many shares should I give an advisor?

The number of shares to give an advisor depends on various factors, including the advisor’s contribution, the stage of the company, its valuation, and the negotiations between the parties involved. There is no fixed rule, and it is typically determined through discussions and considering the advisor’s value to the business.

-

How do you tell if a stock is being diluted?

To determine if a stock is being diluted, you can analyze the company’s financial statements and disclosures. Look for changes in the number of shares outstanding over time. Dilution may occur if the company issues additional shares through stock offerings, employee stock options, or convertible securities.

Useful Video: What are advisory shares on Shark Tank?

References:

- https://pulley.com/guides/advisory-shares

- https://eqvista.com/differences-regular-advisory-shares/

- https://carta.com/blog/advisor-advisory-shares/

- https://allsharktankproducts.com/show-all/

- https://en.wikipedia.org/wiki/Shark_Tank

- https://abc.com/shows/shark-tank/about-the-show

- https://www.ondexa.com/41/advisory-shares-on-shark-tank/

- https://www.ondexa.com/41/advisory-shares-on-shark-tank/

- https://marketrealist.com/p/what-are-advisory-shares-on-shark-tank/

- https://smartasset.com/investing/advisory-shares

Leave a Reply