CoinOut, the innovative digital solution designed to tackle the age-old problem of unwanted loose change, made quite a splash on the hit TV show “Shark Tank”.

Founded by entrepreneur Jeff Witten, this ingenious platform promised to streamline how consumers deal with those pesky pennies and transform loose change into easily manageable digital assets. After securing a deal with one of the “Shark Tank” investors, CoinOut embarked on a journey to revolutionize the way we handle small denominations.

In this article, we delve into what has happened to CoinOut since its memorable appearance on the show, exploring its growth, evolution, and impact on the financial landscape.

What Is CoinOut?

How Does CoinOut Work?

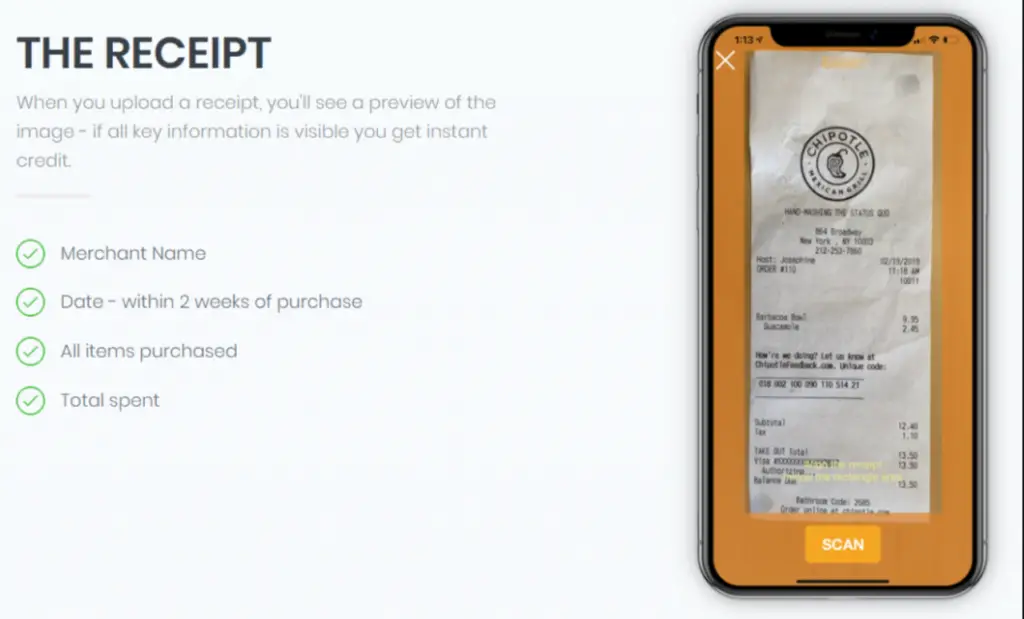

Using CoinOut is straightforward. After making a purchase, the user scans the receipt using the app. Once approved, the app credits a random amount between $ 0.01 to $ 0.15 per receipt to the user’s account. While the earnings per receipt may seem small, frequent shoppers may find this as a passive way to accumulate some extra cash [2].

CoinOut differentiates itself from many other receipt scanning apps by not considering your transaction total when determining your earnings. Instead, the company establishes a daily range, encompassing a minimum and maximum amount you can earn from a receipt. The specific amount you receive is randomized and unrelated to the receipt type or expenditure.

While the earnings may not be substantial, it’s essential to remember that this is a common characteristic of receipt scanning apps in the digital rewards landscape. It’s a legitimate way to get paid for your shopping activities, provided you consistently upload your receipts.

Pros:

- User-Friendly Interface: CoinOut has a simple, intuitive interface that makes it easy for users to navigate and use;

- Passive Earnings: CoinOut provides a passive way to earn small sums of money. All you need to do is scan your receipts, and the app does the rest;

- Positive Reviews: CoinOut has received overwhelmingly positive reviews from users who love the concept of earning money from something they already do — shopping. Merchants also appreciate the convenience the app brings;

- Steady Growth: Since its inception, CoinOut has shown steady growth. Its valuation increased from $ 3.3 million after its pitch on Shark Tank to an estimated net worth of $ 5 million in 2023;

Cons:

- Small Earnings: One of the main criticisms of CoinOut is the relatively small amount users earn per receipt, often $ 0.03 or less. This may be off-putting for those expecting to make significant earnings;

- Limited Opportunities: Your earning potential is directly tied to how often you shop and how many receipts you have. This limits the earning opportunities, especially for those who don’t shop frequently;

- Not a Get-Rich-Quick Scheme: CoinOut is not a way to get rich quickly. It is more of a tool for stretching your budget and making a little extra cash on the side [3];

Safety Of CoinOut

Yes, CoinOut is a safe platform.

An additional layer of security comes from FDIC insurance covering the funds in your CoinOut account, a feature that is relatively rare for a rewards app. Furthermore, CoinOut collaborates with a security compliance firm to proactively detect and address potential vulnerabilities.

In essence, CoinOut adheres to safety practices consistent with other reputable apps. However, it’s advisable to weigh the benefits of earning a few dollars on the side against the data you share with this “beermoney” app, as with any online service.

Who May Benefit From Using CoinOut:

- Frequent Shoppers: Those who shop regularly, both in-store and online, stand to gain the most from CoinOut. The app allows users to earn cash back for their shopping activities, turning everyday purchases into a source of passive income;

- Budget-Conscious Consumers: For individuals looking to stretch their budget further, CoinOut can be an excellent tool. It gives rewards regardless of what you buy, eliminating the need to search through the app for specific offers;

- Data-Sharing Enthusiasts: CoinOut rewards its users for sharing their recent shopping history. If you’re comfortable with this level of data sharing, you could earn from it;

- Loyalty Program Participants: CEO Jeff Witten and his team have incorporated smart customer communication and loyalty capabilities into CoinOut. This feature could benefit consumers who enjoy participating in loyalty programs;

- Users Seeking Minimum Cash Out Thresholds: CoinOut has a low minimum balance requirement for cashing out — just $ 1. This makes it an attractive option for those who prefer to withdraw their earnings frequently [5];

Remember, while CoinOut offers an easy way to earn some extra cash, it’s not a get-rich-quick scheme. The earnings per receipt are usually between 2 cents and 20 cents, so it’s more about making a little extra from your regular shopping habits.

About Founders Of CoinOut

Jeff begins by asking the Sharks if they’ve ever had a great morning at their favorite coffee shop, only for the mood to sour when it’s time to deal with the mountain of loose change they receive. Jeff shares his disdain for loose change, considering it dirty and impractical for wallets or skinny jeans. He emphasizes that receiving coins as part of your change is an annoying, inefficient, and outdated way to conduct transactions.

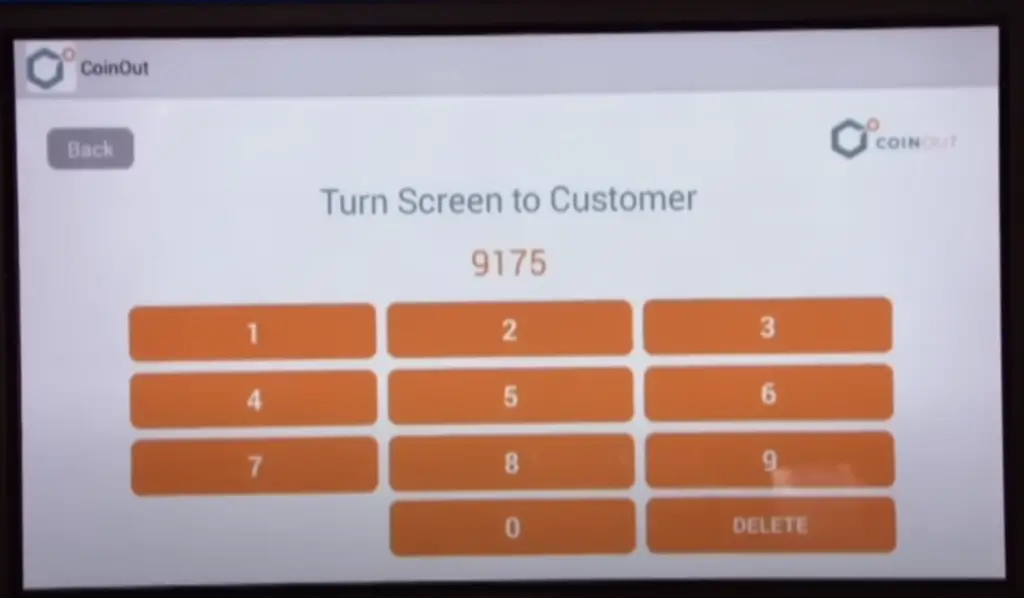

Instead, Jeff presents CoinOut as the ultimate solution to digitize loose change, finally getting rid of those pesky pennies and giving people full control over their money. He proceeds to demonstrate how it works. When you pay with cash at a participating merchant and receive, for example, $ 1.34 in change, all you need to do is hand over your CoinOut card and let them know you want to “CoinOut”.

The merchant’s screen will prompt you to enter your phone number at checkout, allowing you to choose whether you want to CoinOut just the coins or the entire change amount. The selected change is then transferred to your CoinOut wallet. After confirming the transaction, you receive a text message as confirmation, along with instructions to set up your account online later.

The beauty of CoinOut lies in its simplicity. There’s no need to download an app, provide financial information, or sign up until you’re ready to cash out. Carrying around those cumbersome coins no longer makes sense. So, the next time you’re at the checkout counter, remember to CoinOut!

The Pitch Of CoinOut At Shark Tank

Kevin raises a valid question – can he utilize his CoinOut wallet for his next coffee purchase? This is one of the possibilities. There exist four alternatives – transferring to a bank account, converting it into an Amazon gift card, contributing to a charitable cause, or redeeming it in a physical store. Kevin queries Jeff about his ability to survive in this competitive landscape without getting squashed like an insect. How can he outlast the colossal payment operators in the long run? Jeff can explain [7].

Cash is not a novel concept. That’s Jeff’s response. The reason no one has attempted this before is that everyone in the industry believes cash is on its way out. Mark refutes this idea, asserting that cash isn’t going anywhere. Even Bitcoin enthusiasts don’t foresee the demise of cash. Kevin reiterates his concerns that Jeff is headed for failure. However, Jeff and CoinOut won’t easily succumb. The technology they’ve developed is replicable but challenging to create. Additionally, establishing a banking relationship and a regulatory framework is imperative. Kevin remarks that it feels like attending a funeral.

Barb inquires about the purpose of the screen at the retailer’s establishment – what’s in it for them? Jeff explains that handling cash is a costly affair for retailers, particularly when it involves armored truck deliveries and dealing with coins, just like at Barb’s local pizzeria. The primary reason to switch to CoinOut is cost reduction. It also serves as an effective loyalty program for retailers.

Kevin attempts to speak again, but the other Sharks silence him. He then humorously mentions that the demonstration barista appears fearful, aware that Jeff might be facing a challenging situation. She can’t help but chuckle. Jeff shifts the focus back to the second reason for signing up with CoinOut – the loyalty program. It’s especially crucial for retailers as it bridges the gap between the merchant and the previously anonymous cash-paying customer.

Robert expresses his enthusiasm for the concept. He detests carrying change, but Barb jokes that it’s because he’s wealthy. Robert prompts Jeff to elaborate on how he generates revenue. They charge merchants $ 20 per month and also earn a 3% commission on each transaction. Mark and Kevin react with surprise and disbelief. Jeff recalls his inspiration from watching the Scrub Daddy episode on Shark Tank, with his law textbook beside him. He admired the entrepreneur’s passion and emotional investment in his product and aspired to be the next Scrub Daddy.

The entire journey has been a lengthy and arduous one. Jeff extensively researched the market, declined a full-time job offer at Apple, and turned down a clear path toward corporate law. Besides investing time and money, he managed to secure $ 460,000 from friends, family, and personal funds.

Mark acknowledges that people seek alternative payment methods to simplify their lives, but he raises concerns about the cost of encouraging users to adopt the application. He humorously raises his credit card as a solution. Jeff stammers and concedes a temporary defeat. Nevertheless, the statistics present a different story – 32% of all transactions in the United States involve cash, surpassing credit and debit card usage.

Jeff emphasizes the importance of data, noting that major coffee chains engage only 15% of their customers in loyalty programs, missing out on cash-paying customers who are reluctant to download an app. Large retailers stand to benefit from CoinOut.

Barb commends Jeff’s ability to hold his own in discussions with Kevin and treat Mark as an equal. She admires his composure and gains respect for him. Robert points out that the Sharks have highlighted the challenges, and he encourages Jeff to focus on what’s working for CoinOut. In just four months, they’ve processed 2,500 transactions, and satisfied customers are returning.

Jeff’s real problem-solving centers on those resistant to change. While loyalty and other features are beneficial, overcoming the change barrier is fundamental. Mark appreciates the clever phone number storage concept, believing it to be a brilliant idea for any loyalty program. However, he remains concerned that Jeff is too focused on CoinOut and neglecting the potential for a broader solution. Mark decides to exit the deal.

Lori reveals her aversion to coins and cash, making her an ideal customer for Jeff. She expresses uncertainty about the success of CoinOut and the return on her $ 250,000 investment. She, too, decides to opt out, leaving only two Sharks.

Kevin presents an offer, acknowledging the previous rejection of a contingency deal for 15%. He proposes $ 250,000 in exchange for 25%, considering that Jeff might be reluctant to scale at the desired pace [8]. Jeff feels the absence of warmth from Kevin but recognizes the business aspect of the offer. Robert makes his offer of $ 250,000 for 15%, with the condition of a successful pilot involving a large-scale retailer.

In the end, Jeff accepts Robert’s deal with a single contingency – Kevin is not allowed to use the product.

CoinOut After The Shark Tank

However, it appears that the core functionality has evolved. You no longer have the option to cash out in physical currency; instead, you’re limited to the bank and gift card redemption choices. This shift raises concerns, as CoinOut now resembles products like Ibotta and deviates from the idea of having cash readily available in your wallet, akin to a cashback system at a typical gas station. The process now involves scanning your receipt and uploading it to receive credits on the app.

While CoinOut retains its monthly cost of $ 19.99 for merchants, it appears to offer a dynamic pricing model based on business size [10], along with volume and premium packages. CoinOut is marketed as a clever tool to boost sales, emphasizing its robust security measures, including two-factor authentication and FDIC insurance at the operating bank. Their commitment to encryption and security is commendable.

Overall, the future of CoinOut is something to look forward to, and its evolution in the market is bound to be interesting.

The Net Worth Of CoinOut

CoinOut’s founder, Jeff Witten, also saw his net worth rise to an estimated $ 3 million as of 2023. Under his leadership, the company reported an annual revenue of $ 12 million as of June 2021, demonstrating the app’s profitability.

Alternatives To CoinOut:

- Fetch Rewards: This app allows users to earn points by scanning grocery receipts, which can then be redeemed for gift cards;

- Ibotta: Ibotta offers cash back for both in-store and online purchases. Users can either link their store loyalty cards, purchase through the app, or submit a photo of their receipt to earn cash back;

- Receipt Hog: This app rewards you with coins or spins when you take pictures of your receipts from any store, restaurant, or cafe and upload them to the app;

- Receipt Pal: Similar to Receipt Hog, Receipt Pal also offers rewards for uploading pictures of your receipts;

- Box Tops for Education: This app allows you to scan your store receipt, find participating products, and instantly add Box Tops to your school’s earnings online;

- Foreceipt Receipt Tracker App: This app helps you track your personal and business expenses. It’s more of an expense-tracking tool than a cashback app, but it’s a good alternative if you’re looking to keep an eye on your spending;

- ABUKAI Expense Reports Receipt: Much like Foreceipt, ABUKAI is an expense tracking tool designed for businesses;

- Huyu, Shoppix, and Zipzero: These apps, mentioned in a Reddit thread, also offer rewards for scanning receipts [12];

FAQ:

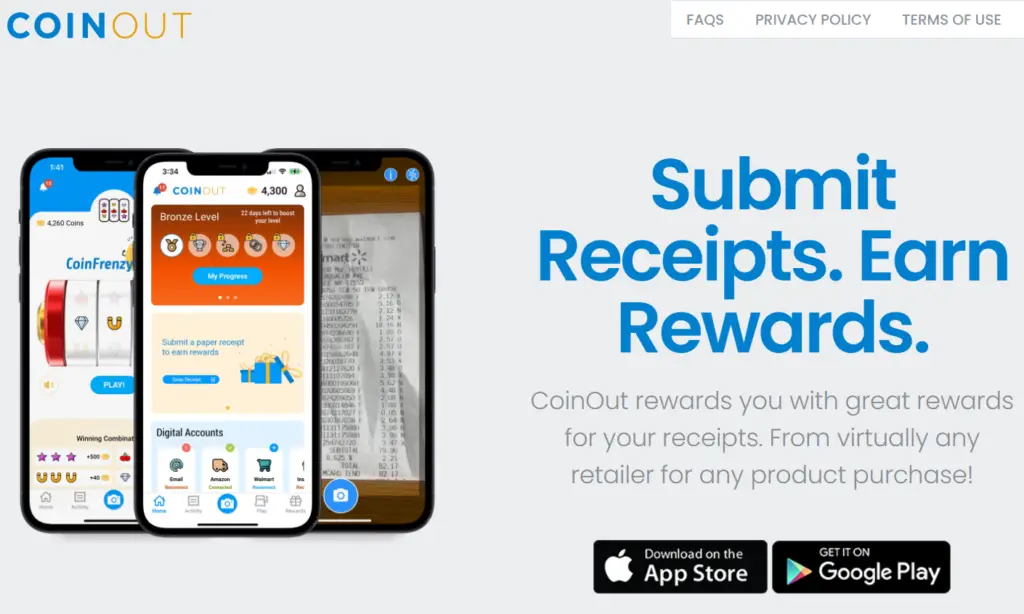

- Is CoinOut available on iPhone and Android?

Yes, CoinOut is available on both iPhone and Android. The app can be downloaded from the Apple App Store and Google Play Store.

- Where is the CoinOut headquarters?

CoinOut’s headquarters is located in New York City, NY, USA.

- What is the must for merchants to accept CoinOut?

Merchants need to integrate with CoinOut’s system to accept it. They should also have an agreement with CoinOut to offer cash back to their customers.

- How do you get your money back with CoinOut?

Users can earn cash back by taking a picture of their receipt from any retailer and uploading it to the CoinOut app. The app then rewards users with cash back for each receipt.

- How do you withdraw your money with CoinOut?

Once you’ve earned enough rewards, you can withdraw your money directly to your bank account, through PayPal, or by choosing a gift card from a selection of retailers.

- What CoinOut receipts do not qualify for cashback?

Receipts that are not accepted by CoinOut include those more than 2 weeks old, receipts from ATMs, credit card slips, money orders, pictures of barcodes or QR codes, and invoices.

- What is the user interface of CoinOut?

The CoinOut app has a simple and user-friendly interface. The main screen shows your current balance and options to scan a receipt, view past transactions, and withdraw your earnings.

- Are there any subscription fees for CoinOut users?

No, CoinOut is free to use. There are no subscription fees for users.

- What is the net worth of Jeff Witten?

As of 2023, CoinOut founder Jeff Witten’s estimated net worth is $ 3 million.

- Is CoinOut successful after Shark Tank?

Yes, CoinOut has been quite successful after its appearance on Shark Tank. It gained significant exposure from the show and has since grown its user base and revenue.

- Who bought CoinOut?

CoinOut was acquired by IRI, a leading provider of big data, predictive analytics, and forward-looking insights that help CPG, OTC healthcare organizations, retailers, and media companies grow their businesses.

- Why did CoinOut change?

CoinOut evolved in response to user feedback and the changing market dynamics. The goal was to improve the user experience and offer more value to its users.

- Is CoinOut worth it?

Whether CoinOut is worth it or not depends on individual shopping habits. For frequent shoppers who don’t mind sharing their purchase data, CoinOut can be a good way to earn some extra cash back.

- Is CoinOut better than Fetch?

Both CoinOut and Fetch Rewards have their strengths. CoinOut accepts receipts from all retailers, while Fetch Rewards focuses on grocery stores. The choice between the two would depend on a user’s specific needs and shopping habits.

- How long does CoinOut take to payout?

Payout times can vary, but users typically receive their money within a few business days.

- Does CoinOut have a limit?

There is no stated limit on the number of receipts you can upload daily. However, there is a maximum of $ 20 cash back per receipt.

- What merchants use CoinOut?

CoinOut works with a wide variety of merchants. Any retailer that provides a receipt is essentially compatible with CoinOut.

Useful Video: CoinOut Entrepreneur Shuts Down The Sharks & Treats Them As “Equals”

References:

- https://sharktankrecap.com/coinout-update-shark-tank-season-9/

- https://www.sharktankblog.com/business/coinout/

- https://bizzbucket.co/coinout-shark-tank-update/

- https://biznewske.com/coinout-shark-tank-update/

- https://www.sharktanksuccess.com/coinout-app-shark-tank-review/

- https://2paragraphs.com/2020/11/coinout-what-happened-after-250000-robert-herjavec-shark-tank-deal/

- https://sharktanktales.com/coinout-shark-tank-update/

- https://geeksaroundglobe.com/coinout-net-worth-update-before-after-shark-tank/

- https://www.reddit.com/r/sharktank/comments/1569jba/everyone_missed_the_purpose_of_coinout_s9e23/

- https://thisonlineworld.com/coinout-app-review/

- https://gazettereview.com/2018/07/coinout-after-shark-tank-update/

- https://support.coinout.com/hc/en-us

Leave a Reply